Are you thinking about buying an insurance agency? Here are some things to consider.

Are you prepared?

Being prepared consists of 3 main components.

- Experience: Have experience in selling insurance. Insurance sales experience is crucial to your success as an insurance agency owner. It is possible to succeed without it, but your odds increase dramatically if you’ve sold insurance before. If you do not have this experience slow down and take the time to gain this experience before proceeding with an acquisition.

- Credit History: Know your credit history and if its a colorful one, deal with it now. Bad credit can lead to potential hurdles when trying to secure carrier contracts or business loans.

- Financial Preparedness: Be financially prepared to satisfy minimum liquidity requirements of potential carriers, down payments, and having your personal obligations in order.

Know your target

Know what kind of agency you’re targeting. This includes identifying if you are seeking an agency that is primarily focused on personal lines products or commercial lines. Knowing your target also includes choosing between a captive carrier agency or an independent agency. Your experience will be a valuable aid in helping your decide.

Geographical considerations

Target an agency in community where you are already established. This will allow you to leverage existing relationships with individuals and businesses to get your foot in the door for some added new business growth. This should also assist you by having some familiarity with the local insurance climate.

Due diligence

Know the carrier strength of the agency.

It is important to understand the quality of carriers associated with the agency you hope to acquire. One of the best resources available for this is AM Best.

Standard items you should require from your seller include:

- Most recent 3 years of agency income tax returns

- Current year to date and previous 3 years of agency income statements and balance sheets

- Current year to date and previous 3 years of agency reports showing performance data such as loss ratios, retention rates, and a breakdown of premiums by carrier and type.

- Copies of any legal agreements such as leases and employment agreements.

Seek counsel

It is best practice to have an attorney available to review contracts already in place at the agency and to assist with the drafting and/or review of transactional documents.

Know how you will fund your new venture

Most acquisitions involve a loan component. Save time and money by utilizing a lender that specializes in insurance agency lending. Prepare yourself by organizing your last three years of federal tax returns and prepare a current personal financial statement and resume.

Only you know when you are ready.

You will know when you are ready and when you’ve done all that you can to prepare for acquiring a new insurance agency. If you have taken the time to get prepared and you know what to look for in an agency, you have a great start.

If you are ready to start, but you feel like talking to some people who have been involved in hundreds of millions of dollars’ worth of insurance agency acquisitions give us a call at Capital Resources. We love talking to others in the industry and offering free advice and some analysis. If we gain a new loan customer along the way, then that’s great. We are happy to discuss your potential transaction with you to provide you with the knowledge based tools necessary for a successful insurance agency acquisition.

1-866-523-6641

Now it’s time to go find your new agency!

YOU MAY ALSO LIKE

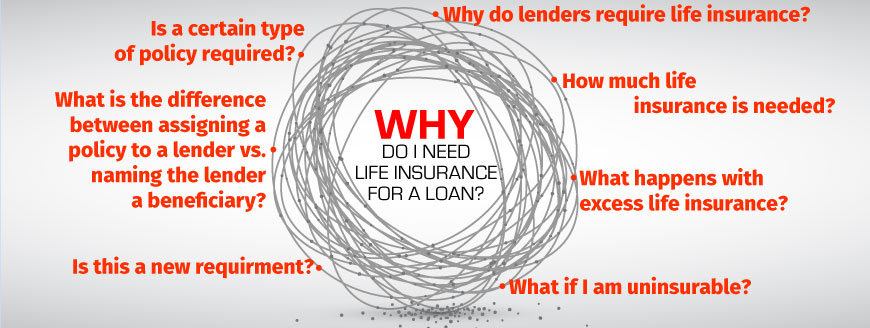

Why Do I Need Life Insurance for an Insurance Agency Loan?

Why Do I Need Life Insurance for an Insurance Agency Loan? There is a lot that goes into applying for and obtaining a business loan for your small business. Applications, personal financial statements, tax returns, profit and loss statements and business reports are...

Securing a Loan for Your Insurance Agency Shouldn’t be a Complicated Mess

Obtaining a business loan for your insurance agency shouldn’t be so confusing... ...unfortunately it can be. When evaluating your loan options consider the following 4 main variables: What is your primary objective/reason the loan. What costs will be associated with a...