Why Choose Capital Resources? Better Cash Flow.

For most insurance agency owners, the single most important factor to them when considering an insurance agency loan for their Allstate, Farmers, or independent agency loan is agency cash flow. That is why we have made it a priority to offer insurance agency loans that maximize agency cash flow through minimizing the monthly loan payment on our agency loan products.

We consistently beat out the competition when it comes to the lowest monthly loan payment. This is accomplished through offering some of the most competitive interest rates available today. Additionally, we are able to offer lower loan payments on our insurance agency loans by offering the longest loan terms in the market place. We offer loans with amortizations as long as 15 years. You won’t find that from other lenders very often.

Would you like to be contacted for a RISK FREE consultation?

If so, please click the button below.

Or call us today at 1-866-523-6641.

YOU MAY ALSO LIKE

Customer Experience Survey Results.

Customer Experience Survey Results for 2017 and 2018. In 2017, Capital Resources began surveying each new and existing customer who obtains an insurance agency loan from us. The results have been overwhelmingly positive. The survey is intended to better understand how...

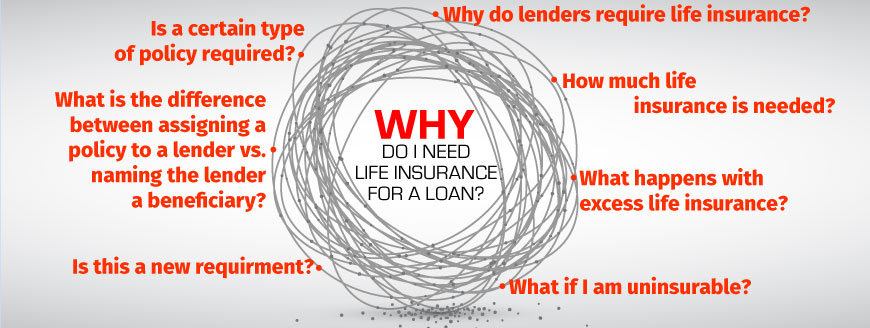

Why Do I Need Life Insurance for an Insurance Agency Loan?

Why Do I Need Life Insurance for an Insurance Agency Loan? There is a lot that goes into applying for and obtaining a business loan for your small business. Applications, personal financial statements, tax returns, profit and loss statements and business reports are...

Securing a Loan for Your Insurance Agency Shouldn’t be a Complicated Mess

Obtaining a business loan for your insurance agency shouldn’t be so confusing... ...unfortunately it can be. When evaluating your loan options consider the following 4 main variables: What is your primary objective/reason the loan. What costs will be associated with a...