Why Choose Capital Resources as Your Agency Lender? We Believe In You

We won’t require that you ask Uncle Sam for help. Many of the banks that have recently begun lending to insurance agency owners will only do so if you qualify for government assistance through the SBA. At Capital Resources, we believe that your agency and your ownership of it are the two most valuable factors in the lending equation not a third party SBA guarantee.

If you are contemplating a loan for your Allstate, Farmers, or independent insurance agency then choose a lender who believes in you and the value in your insurance agency. Not one who will only lend to insurance agencies if they jump through the many hoops of an SBA loan.

Would you like to be contacted for a RISK FREE consultation?

If so, please click the button below.

Or call us today at 1-866-523-6641.

YOU MAY ALSO LIKE

Customer Experience Survey Results.

Customer Experience Survey Results for 2017 and 2018. In 2017, Capital Resources began surveying each new and existing customer who obtains an insurance agency loan from us. The results have been overwhelmingly positive. The survey is intended to better understand how...

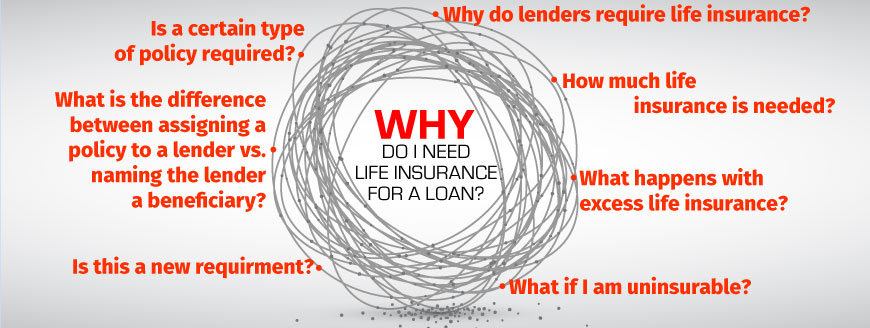

Why Do I Need Life Insurance for an Insurance Agency Loan?

Why Do I Need Life Insurance for an Insurance Agency Loan? There is a lot that goes into applying for and obtaining a business loan for your small business. Applications, personal financial statements, tax returns, profit and loss statements and business reports are...

Securing a Loan for Your Insurance Agency Shouldn’t be a Complicated Mess

Obtaining a business loan for your insurance agency shouldn’t be so confusing... ...unfortunately it can be. When evaluating your loan options consider the following 4 main variables: What is your primary objective/reason the loan. What costs will be associated with a...